Introduction:

There are many loan apps available in play store, but True Balance app is the rapidly expanding personal loan app. Despite its popularity, many people hesitate to use this app, and they have many doubts about true balance.i n order to address these doubts, we are going to do true balance app review, which will solve all the doubts about the true balance app.

What is True Balance App?

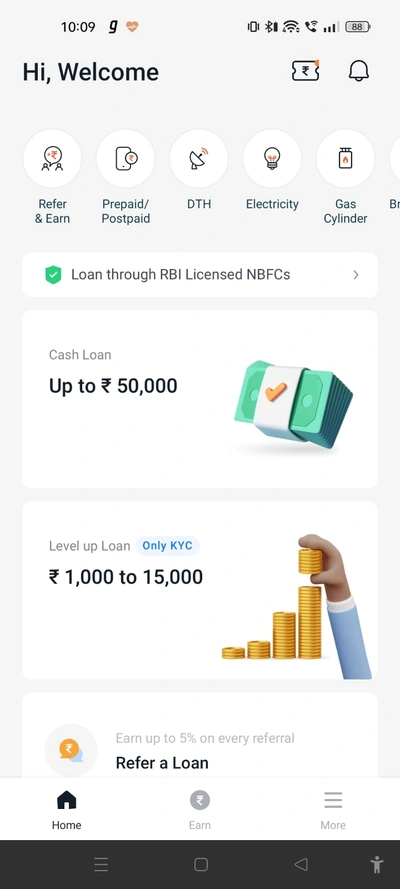

True Balance App is a financial app which provide many service to people including prepaid and postpaid recharges, bill payment and instant online personal loan.

True Balance Loan Review: Navigating Loan Options and Considerations

True Balance app offers loan facility and bill payment facility, which makes it more than just a loan app. Despite this, the app’s owner promoting true balance app as a personal loan application, resulting in its increasing popularity among users seeking loans.

Loan Offering Overview:

Before reading the true balance review, we want to tell you that this is our personal review, and we have given this review after using the app.

This true balance app offers loan from 5000 to 50,000 with a loan duration of 62 to 116 days. Only KYC is required to obtain a loan from true balance app and if your credit score is good then you will get the loan instantly.

Loan Types and Terms:

This true balance app provides 3 types of loans first loan is welcome loan (up to 7000 loan), second level up loan (up to 15000) and third maximum loan (up to 50 thousand loan). The three types of loans have different interest rates, tenures and processing fees.

Interest Rates and Fees:

True Balance app offers a wide variety of personal loans as compared to other loan apps. However, app’s interest rate and processing fee is a bit high.

This app charges interest rate ranging from 5% to 12% monthly. On the other hand, if we talk about other personal loan apps, they also charge almost the same amount of interest.

We recommend by taking loan from these apps if you need money in emergency situations. Otherwise, avoid these types of loans that have high interest, high processing fees, and high late fee charges.

Our personal review

In our personal We borrowed a loan from this app, but after some months we delayed the EMI then we had to pay extra charges of Rs.7,000 on a loan amount of Rs.10,000, So that was our bad experience with this app.

At last, we have come to the conclusion that if you need emergency loan then it will give you instant loan but if you are eligible to take loan from any government or private bank then you should take loan from those banks because their interest rate and other charges are low.

Read also – cheaper loan details in hindi

Read also –Pradhan Mantri Mahila Loan Yojana details in hindi

True Balance App Bill Payment Review: Simplifying Financial Transactions

True balance provides all type of bill payment like, DTH, prepaid-postpaid mobile recharge, electricity, water, LPG etc. and we are using this app to quickly pay bills using various methods such as UPI, debit/credit cards, and net banking, So we have been great experience with their bill payment system.

Conclusion:

After doing true balance review, we are considering all the negative and positive points of True Balance App, and we have come to the conclusion that True Balance is a genuine app and this app provides loans to all people.

Finally, we would like to offer some advice: If you are not in emergency for money then do not borrow loan from this app because as it imposes high interest rate and high penalty charges.

FAQ:

true balance app is safe or not?

True Balance app is owned by the famous app named TrueCaller. Therefore, millions of people using TrueCaller app, and the company has established a strong reputation in the market. That’s why the company would not varnish its brand name by production of counterfeit apps, and true balance app is approved by RBI. Therefore, we can say that you can use this app without any hesitation and this app is safe.

What is True Balance Customer Care Number and true balance mail ID?

True balance app customer care number is (0120)-4001028 and true balance mail ID is [email protected].

Is True Balance RBI registered?

Yes, True Balance App is RBI registered.

What will happen if true balance loan not paid?

If you did not repair your loan amount, then your CIBIL score will diminish. Due to which, potentially causing difficulties in obtaining future loans.

I am able to solve technology related problem, that’s why I give useful content about how to tutorial of internet and technology and I love to write about the , free paytm cash apps, online earning app and how to tutorials